Walmart Hopes Third-Party Marketplace Will Snag Holiday Spend From Amazon

With the holiday season on the horizon, retail behemoths such as Walmart and Amazon are preparing to capture the attention and spending of consumers across the globe. Notably, this festive season will witness Walmart placing a heightened focus on its third-party marketplace.

This year, third-party sellers are reportedly allocating more advertising resources to Walmart’s marketplace. Although their numbers still significantly trail Amazon’s extensive third-party partner network, this growing commitment is noteworthy. This significance arises from the less saturated nature of Walmart’s third-party platform compared to Amazon’s.

Where Walmart and Amazon Stand

Walmart launched its third-party marketplace in 2009, a move to diversify its product offerings and compete with Amazon’s seller ecosystem. While Walmart has made progress in this endeavor, it falls short compared to Amazon in several aspects.

One of the differences is the reach of these marketplaces. Walmart focuses on the U.S., Canada and Mexico, limiting its presence. In contrast, Amazon operates a seller network across 22 countries, including markets like Australia, Germany, Japan and the United Arab Emirates. This geographical coverage gives Amazon an advantage in global market penetration.

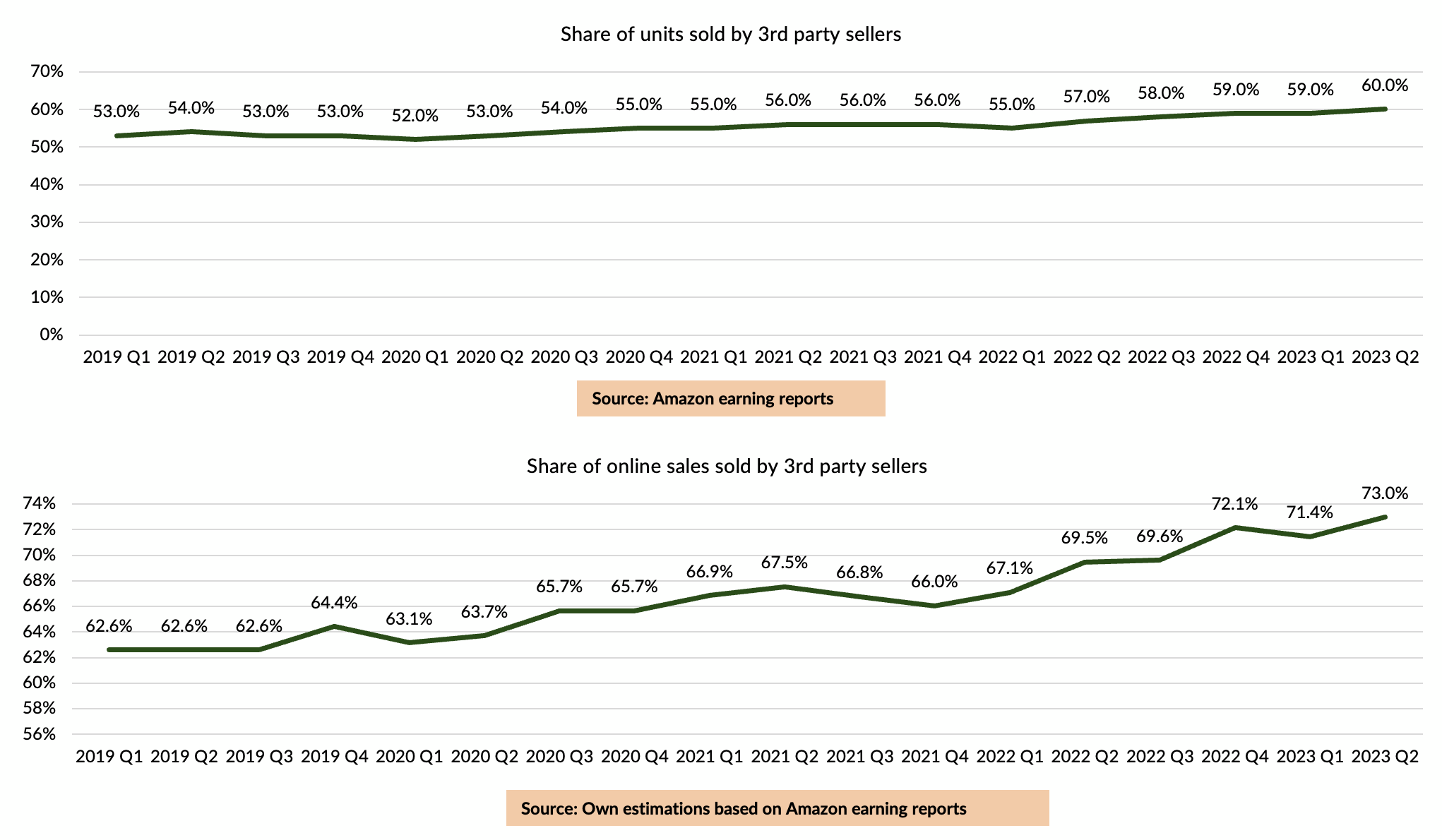

Regarding the proportion of units and sales contributed by third-party sellers on Amazon, as reported by PYMNTS Intelligence, during the second quarter of 2023, six out of every ten units were sold by these third-party sellers. This share has shown consistent, albeit gradual, growth in recent years and is currently up by seven percentage points when compared to the first quarter of 2019.

With that, third-party sales account for 73% of the total value sold online in Amazon.

Meanwhile, Walmart has maintained a notably reserved stance regarding the precise number of vendors in its marketplace, prompting industry experts and analysts to engage in speculative discussions.

This opacity stands in stark contrast to Amazon, which proudly touts an astounding multitude of third-party sellers, estimated to number in the millions. This vast pool of sellers significantly bolsters Amazon’s diverse product selection and fosters competitive pricing, cementing its status as a popular destination for consumers in search of an extensive array of goods.

However, it’s worth noting that while Walmart significantly trails behind Amazon, the company has shown promising signs of advancement. In the past two quarters, its U.S. operations have experienced substantial online growth in the double digits, marking a noteworthy distinction from the declines reported by other prominent retailers such as Target, Best Buy, and Macy’s.

Specifically, eCommerce sales for Walmart U.S. surged by 27% in the fiscal first quarter and 24% in the fiscal second quarter, driven by the strength of its grocery segment, compared to the corresponding period in the previous year.

Amazon’s Advantage

Amazon has effectively leveraged its Amazon Prime membership program to drive higher online sales volumes. Prime members enjoy benefits like free two-day shipping, access to Prime Video and exclusive deals, creating a loyal and engaged customer base.

The membership program not only encourages repeat purchases but also solidifies Amazon’s position as an eCommerce leader. Walmart, while offering its own delivery and subscription services, has yet to offer the all-encompassing appeal of Amazon Prime.

Furthermore, Amazon has made substantial investments in its fulfillment network, featuring numerous distribution centers and advanced logistics technology. This infrastructure enables Amazon to provide rapid and dependable delivery choices to customers, a critical factor in eCommerce success.

In light of these factors, Walmart has indeed made significant progress in strengthening its third-party marketplace. However, it encounters a challenging task when vying with Amazon’s firmly established and worldwide seller network. Although the holiday season might witness Walmart intensifying its efforts, it remains improbable that it will unseat Amazon from its prevailing position in the foreseeable future.